Recently I coached various teams across NPCI along with various banks, a financial org. that’s into digital payments enablement with a consumer base that’s massive, extremely diverse and ever-growing. Now, making payments for anyone is a BIG DEAL esp. safety, security, seamless and fast are few common consumer expectations.The consumers are spread across the entire country and even other parts of the globe, like banks, people like us, investment to financial organisations, corporate to pvt. sector, rural to urban sector, from illiterate, semi-literate to highly educated. Everyone has a different perception of user experience, their problems are different, there are people who know how to complain when they face a problem and there are our people who don’t know how to complain if mobile app is not working or if they are stuck with the app.

Basically, issues that surfaced were not only around safe and secure transactions with bank but around customer experiences like UI/UX, consumer dispute resolution for stuck or failed payments, payments tracking and consolidation and even awreness of what to next in cases of disputes. When the consumer base is extremely diverse, it’s hard to identify who to involve for feedback and how.

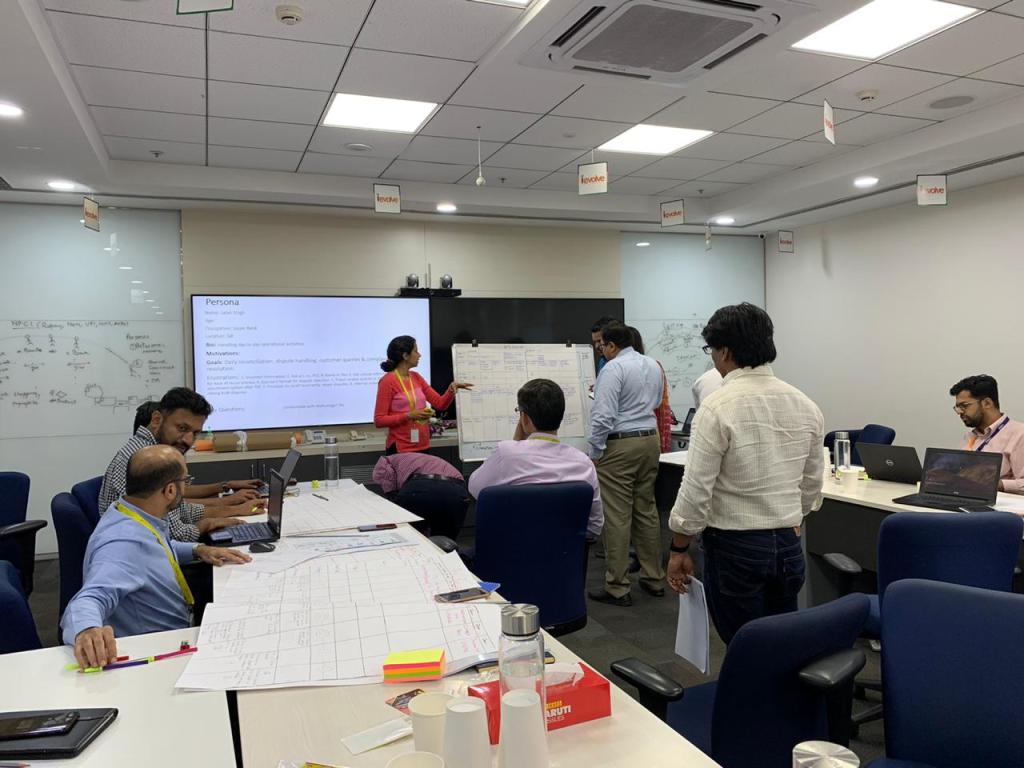

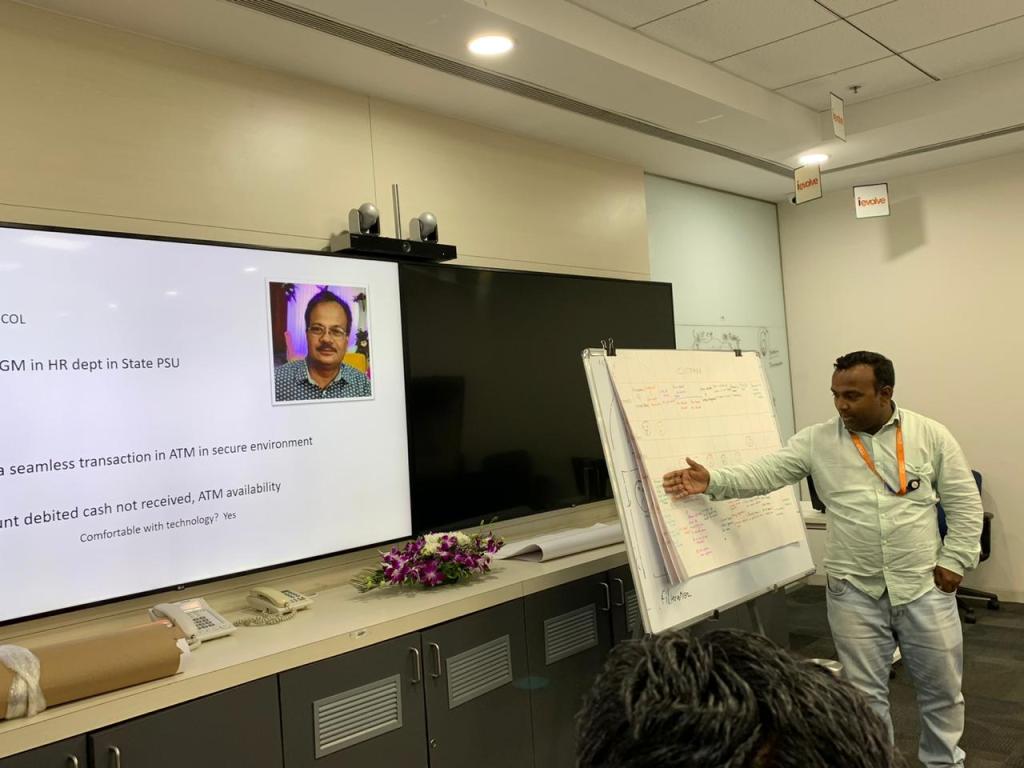

They have a brilliant team open to innovation. While performing Customer Journey mapping, several moments of truth were discovered. Working together was from cross organization, banks, merchants, cross department: Technical Leads, product development team, marketing and sales team, IT architect, customer support, customer relationship, operations, there was extensive collaboration across entire ecosystem that enabled the entire team to dig into so many compelling insights, techno-functional gaps, issues. The team was overwhelmed with this ‘never before experience’ of cross organization collaboration wherein 5 consumer digital payment products were explored simultaneously during this exercise where you are sitting with your competitors to work collectively on problems in one room because you all have vested interest. Each gap becomes a business opportunity for the team each of them which they had never envisioned before even though they had been working in the same sector.

This experience brought in paradigm shift because now the focus was on what are the problems which we want to list and prioritise and work on this, across org. team. During working sessions the teams ideate->prototype->test->iterate->implement but where they had begun was empathy they literally had to go in the field and interview and understand the whole arc of customer experiences and bring in have discussion which also surfaced some hidden insights and many more problems which unfolded. Eventually, all were together trying to solve: how to provide a seamless, secure and fast payment experience for all our consumers? A wow experience. I remember few of the participants sharing in their ‘aha’ moments that ‘the kind of tremendous cross functional learning they had taken away with them had never felt or learnt in the past.

Linkedin Post participant comments